Loading

Get Irs 6251 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 6251 online

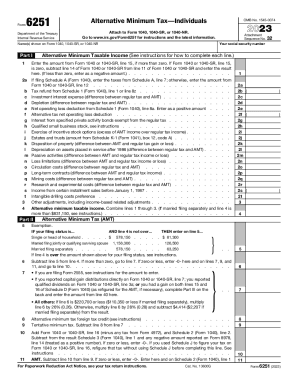

The IRS 6251 form is used to calculate the Alternative Minimum Tax (AMT) for individuals. Completing this form correctly is crucial to ensure accurate tax reporting and compliance with IRS requirements.

Follow the steps to complete the IRS 6251 form online.

- Press the ‘Get Form’ button to access the IRS 6251 online. This will allow you to open the form for editing.

- Begin by entering your social security number and the names as shown on your primary tax form (1040, 1040-SR, or 1040-NR). Ensure this information is accurate to avoid processing delays.

- In Part I, calculate your Alternative Minimum Taxable Income. Enter the appropriate figures based on your 1040 or 1040-SR. If line 15 on your 1040 is zero, subtract line 14 from line 11 and enter the result here.

- Complete lines 2a to 2t, which require you to enter various adjustments that affect your taxable income such as taxes, tax refunds, investment interest, and other deductions. Refer to the instructions located on the form for guidance on each line.

- Combine the totals from lines 1 through 3 to calculate your Alternative Minimum Taxable Income (line 4). If you are married filing separately and this amount exceeds $831,150, refer to the specific instructions included.

- In Part II, determine your Alternative Minimum Tax. Start with the exemption related to your filing status, and enter it on line 5. If line 4 exceeds the thresholds, refer to the instructions for additional calculations.

- Follow the directions to calculate your tentative minimum tax on lines 7 through 11. This involves subtracting the calculated amounts from earlier lines to arrive at your AMT.

- If required, complete Part III for the tax computation using maximum capital gains rates by entering the necessary figures as directed.

- After completing all required sections, you can save your changes, and choose to download, print, or share your completed form.

Start filling out the IRS 6251 online today to ensure your taxes are filed accurately.

Who has to pay the AMT? Filing status2022 AMT phaseout thresholdSingle or head of household$539,900Married, filing separately$539,900Married, filing jointly$1,079,800 Mar 21, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.