Loading

Get Irs 8606 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8606 online

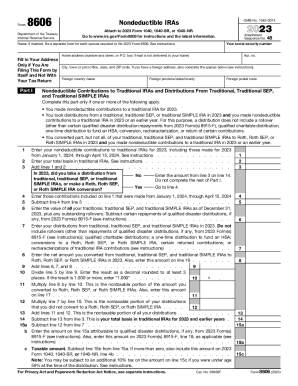

This guide provides clear and comprehensive instructions for filling out Form 8606, which reports nondeductible contributions to traditional IRAs and conversions to Roth IRAs. By following these steps, users can accurately complete the form online, ensuring compliance with IRS regulations.

Follow the steps to complete IRS Form 8606 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your social security number in the designated field. It is essential to ensure this number is correct, as it ties the form to your tax records.

- If you are married and filing separately, make sure to fill out a separate form for each spouse.

- Enter your name in the provided section, and include your home address only if you are filing this form by itself and not with your tax return.

- Complete Part I if applicable: Enter your nondeductible contributions to traditional IRAs for 2023, including contributions made from January 1, 2024, through April 15, 2024.

- Provide your total basis in traditional IRAs. Add the amounts from the previous two lines.

- Indicate whether you took distributions from traditional IRAs or made conversions. If you did, follow the prompts to enter the necessary amounts.

- Continue filling in the remainder of Part I based on the instructions provided. This includes calculating the nontaxable portions of distributions and conversions.

- Move on to Part II if you converted any of your IRAs to Roth IRAs. Enter the required amounts from your previous calculations.

- Complete Part III if you took distributions from Roth IRAs, noting the total and qualified first-time homebuyer expenses.

- Finalize the form by reviewing all entries for accuracy. Once complete, save your changes, and you may download, print, or share the form as needed.

Complete your IRS documentation online to ensure accuracy and compliance.

Use Form 8606 to report: Nondeductible contributions you made to traditional IRAs; Distributions from traditional, SEP, or SIMPLE IRAs, if you have a basis in these IRAs; Conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs; and.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.