Loading

Get Irs 1040 - Schedule Eic (sp) 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule EIC (SP) online

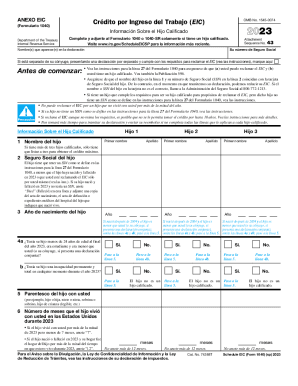

Filling out the IRS 1040 - Schedule EIC (SP) is an essential step for eligible users seeking to claim the Earned Income Credit. This guide provides a detailed walkthrough of each section of the form to help you complete it accurately and efficiently online.

Follow the steps to complete the IRS 1040 - Schedule EIC (SP) online.

- Press the ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by entering your Social Security number in the designated field.

- Fill in your name as it appears on your tax return, ensuring that it matches your Social Security records.

- If you are separated from your partner and filing separately, indicate this by checking the appropriate box.

- Provide information about your qualifying child. Start with the child’s name and Social Security number, making sure they match the child’s Social Security card.

- List the child’s year of birth in the specified section.

- Answer the questions regarding the child’s age and student status by marking the appropriate responses.

- Briefly describe the relationship of the child to you (e.g., son, daughter, etc.).

- Indicate the number of months the child lived with you during the year, ensuring the total does not exceed 12 months.

- If you have more than three qualifying children, remember to only list those applicable to maximize your credit.

- Once you have filled in all necessary information, review the form for accuracy and completeness.

- Finally, save your changes. You can download, print, or share the completed form as needed.

Complete your IRS forms online to ensure accurate submissions and maximize your benefits.

Related links form

The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. Did you receive a letter from the IRS about the EITC?

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.