Loading

Get Irs 8801 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8801 online

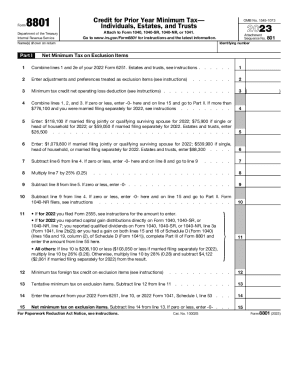

The IRS 8801 form is used to calculate the credit for prior year minimum tax for individuals, estates, and trusts. This guide will provide clear, step-by-step instructions on how to effectively complete this form online.

Follow the steps to accurately complete the IRS 8801 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin with Part I, where you will combine the amounts from lines 1 and 2e of your 2022 Form 6251. If you are filling out this form for an estate or trust, check the specific instructions provided.

- Enter any adjustments and preferences on line 2 that are treated as exclusion items. Make sure to check the instructions for proper details.

- For line 3, calculate the minimum tax credit net operating loss deduction. Ensure accurate calculations based on preceding instructions.

- Combine the values from lines 1, 2, and 3 on line 4. If the result is zero or less, enter '0' and proceed to Part II. If the amount exceeds specified thresholds and you're married filing separately, follow the instructions accordingly.

- Next, enter the amounts specified for your filing status (e.g., $118,100 for married filing jointly) on the relevant line.

- Continue calculating on line 5 based on the given amounts for your filing status. Further lines will require calculations as per provided instructions.

- Complete the subsequent lines by performing the necessary calculations detailed in the form, including any subtractions or multiplications as required.

- After completing Part I, proceed to Part II to calculate the minimum tax credit and carryforward to the next year, following similar processes outlined in the form.

- If applicable, move on to Part III, which involves tax computation using maximum capital gains rates, ensuring all previous steps have been accurately filled.

- Finally, review all entries for accuracy. Once satisfied, save your changes, download a copy of the form, print it if needed, or share it with your tax preparer.

Start filing your IRS 8801 form online today to ensure you maximize your credits.

Related links form

Purpose of Form Use Form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (AMT) you incurred in prior tax years and to figure any credit carryforward to 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.