Loading

Get Ny Dtf It-2105.9 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-2105.9 online

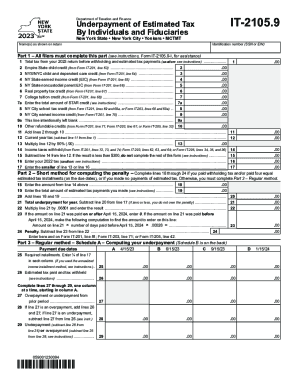

The NY DTF IT-2105.9 form is essential for individuals and fiduciaries to calculate any underpayment of estimated tax in New York State. This guide provides a clear and systematic approach to filling out the form online, ensuring accuracy and compliance with state tax regulations.

Follow the steps to complete the NY DTF IT-2105.9 online effectively.

- Press the ‘Get Form’ button to access the NY DTF IT-2105.9 form and open it in the online editor.

- Begin by entering your name as shown on your tax return in the designated field.

- Fill in your identification number, which can be your Social Security Number (SSN) or Employer Identification Number (EIN), in the appropriate section.

- Complete Part 1 by entering the total tax from your 2023 return before any withholding and estimated tax payments.

- Continue with line 1 through line 17 in Part 1, entering specific credit amounts as directed from Form IT-201.

- For lines 2 to 10, input refundable credits, ensuring to reference the correct lines from Form IT-201.

- Add the amounts from lines 2 to 10 and write the total on line 11.

- Subtract line 11 from line 1 to determine your current year tax, and enter this value on line 12.

- Multiply the amount on line 12 by 90% and enter the result on line 13.

- Complete lines 14 to 17, including income taxes withheld, and determine if you owe any penalty based on previous tax amounts.

- Proceed to Part 2 if you are eligible; otherwise, complete Part 3 as instructed.

- In Part 2, compute the penalty for underpayment by following the calculations on lines 18 to 24.

- If using the Regular method in Part 3, complete Schedule A and Schedule B, keeping track of underpayment and penalty details.

- After finishing all parts of the form, review your entries for accuracy, then save the changes, download the form, or print it as necessary.

Complete your NY DTF IT-2105.9 online today to ensure your tax compliance!

ing to the IRS, you don't have to make estimated tax payments if you're a U.S. citizen or resident alien who owed no taxes for the previous full tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.