Loading

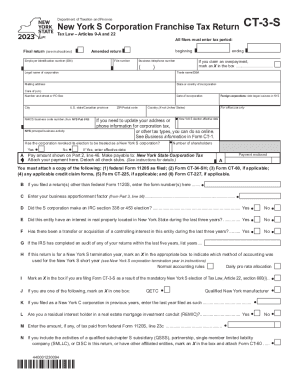

Get Form Ct-3-s New York S Corporation Franchise Tax Return Tax Year 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-3-S New York S Corporation Franchise Tax Return Tax Year 2023 online

Filling out the Form CT-3-S is essential for New York S corporations seeking to report their franchise tax for the tax year 2023. This guide provides comprehensive steps to assist users in completing the form accurately online.

Follow the steps to successfully complete your Form CT-3-S online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax period information, including beginning and ending dates. Ensure the employer identification number (EIN) is accurately filled out.

- Complete the legal name of the corporation and trade name/DBA. Provide the mailing address and state or country of incorporation.

- Indicate whether this is a final return or an amended return by marking the appropriate box.

- Fill in the New York S election effective date and number of shareholders.

- For Part 1, provide required information from your federal Form 1120S, inputting values for ordinary business income or loss, net rental income, interest income, and other specified categories.

- In Part 2, compute your tax by entering the New York receipts, fixed dollar minimum tax, and any recapture of tax credits. Calculate the final tax due after credits.

- Proceed to Part 3 to determine the business apportionment factor based on your New York State sales, rentals, and other business activities.

- Review and double-check all inputted data for accuracy, particularly focusing on any financial data that aligns with federal forms.

- Once all sections are filled out, save your changes, and utilize the options to download, print, or share the completed form.

Begin filing your Form CT-3-S online today to ensure your corporation remains compliant with New York tax regulations.

Mail your return to: NYS CORPORATION TAX, PROCESSING UNIT, PO BOX 1909, ALBANY NY 12201-1909. Private delivery services: See page 3 in the instructions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.