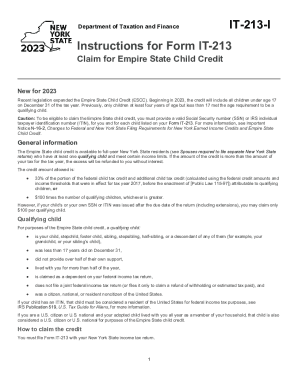

Get Instructions For Form It-213, Claim For Empire State Child ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Instructions For Form IT-213, Claim For Empire State Child Credit online

Filling out Form IT-213, the Claim for Empire State Child Credit, can be a straightforward process with the right guidance. This document provides comprehensive instructions to assist you in completing the form online, ensuring you maximize your available credit for qualifying children.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Confirm your eligibility to claim the credit by ensuring you meet the income limits and have the valid Social Security numbers for yourself and each qualifying child.

- Begin filling out the form by entering your personal details, including your name, address, and Social Security number.

- On line 3, enter your federal adjusted gross income as calculated on your New York State income tax return.

- Proceed to line 4 and enter the number of qualifying children for whom you are claiming the credit.

- If applicable, list the number of children with an ITIN or without an SSN on line 5.

- Complete any necessary worksheets if needed for credit calculations, as outlined in the form.

- If you are a married couple filing separately, follow the specific instructions for entering information related to both spouses on lines 15 and 16.

- After completing all sections of the form and ensuring accuracy, save your changes.

- Download, print, or share the completed form as necessary for your records.

Start filling out your form online today to ensure you receive your Empire State Child Credit.

Do I qualify for the Child Tax Credit? Nearly all families with kids qualify. Some income limitations apply. For example, only couples making less than $150,000 and single parents (also called Head of Household) making less than $112,500 will qualify for the additional 2021 Child Tax Credit amounts. The Child Tax Credit | The White House whitehouse.gov https://.whitehouse.gov › child-tax-credit whitehouse.gov https://.whitehouse.gov › child-tax-credit

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.