Loading

Get Instructions For Form Ct-5.1 - Tax.ny.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Instructions For Form CT-5.1 - Tax.NY.gov online

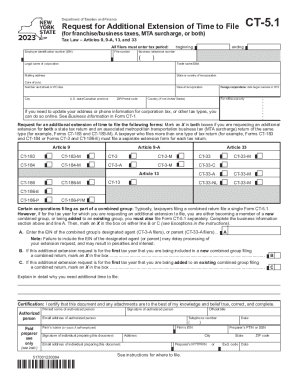

Filling out the Instructions For Form CT-5.1 is essential for requesting an additional extension of time to file franchise or business taxes in New York. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editor.

- Fill in the tax period by entering the beginning and ending dates for the period you are requesting an extension.

- Provide your employer identification number (EIN) and your file number in the designated fields.

- Enter your business telephone number and the legal name of your corporation.

- If applicable, include your trade name or doing business as (DBA) name.

- Complete your mailing address details, including the state or country of incorporation, care of (c/o), street address or P.O. Box, city, state/province, and ZIP/Postal code.

- If you are a foreign corporation, indicate the date you began business in New York State and your date of incorporation.

- Mark an ‘X’ in the boxes indicating the forms for which you are requesting an extension, ensuring to indicate if it is for both a state tax return and MTA surcharge return.

- If you are part of a combined group filing, fill in the necessary details regarding your combined group’s designated agent or parent as applicable.

- In the explanation section, clearly describe the reason you need additional time to file your tax return.

- Certify the document by entering the printed name, signature, and official title of the authorized person. Include their email address and telephone number.

- If a paid preparer is involved, complete the necessary fields for their information including firm name, signature, EIN, email address, and PTIN or SSN.

- Review all entered information for accuracy, then save changes, download, print, or share the form as needed.

Ensure you complete your documents online for a streamlined filing experience.

3. File your federal tax extension forms electronically or via mail. You can print and mail your tax extension forms or file them electronically via the Modernized e-File Program, using an approved provider. You can search for an authorized IRS e-file provider by location.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.