Loading

Get Form It-213 Claim For Empire State Child Credit ... - Tax.ny.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-213 Claim For Empire State Child Credit online

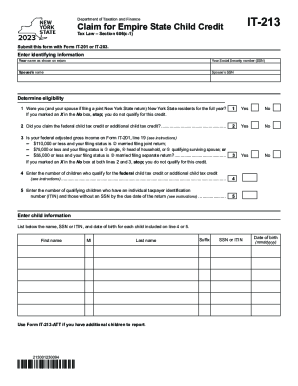

Filing for the Empire State Child Credit is a vital step for eligible individuals and families to receive tax relief. This guide provides clear, step-by-step instructions on how to successfully complete Form IT-213 online, ensuring you understand each section and field.

Follow the steps to effectively fill out the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your identifying information, including your name as it appears on your tax return and your Social Security number. If applicable, provide your spouse’s name and their Social Security number.

- Determine your eligibility by answering the questions regarding your residency status in New York State, whether you claimed the federal child tax credit, and your federal adjusted gross income.

- Indicate the number of qualifying children who are eligible for the federal child tax credit and those who have an individual taxpayer identification number (ITIN).

- For each qualifying child, provide their first name, middle initial, last name, Social Security number or ITIN, and date of birth in the designated spaces.

- If you answered 'Yes' to question 2, complete Worksheets A and B found in the instructions before continuing with the credit calculation section.

- Follow the instructions to enter amounts in lines 6 through 14 based on the worksheets or the number of qualifying children, as applicable.

- If required, complete lines 15 and 16 if you and your spouse are filing separate New York State returns; otherwise, enter the amount from line 14 on Form IT-201.

- Review all entries for accuracy, then save your changes, download, print, or share the completed form as needed based on your filing preference.

Complete your document online now to ensure you don't miss out on this valuable credit.

For the period of July 2023 to June 2024, the maximum annual benefit per child under age 6 is $7,437 ($619.75 per month), and the maximum annual benefit for children aged 6 to 17 is $6,275 ($522.91 per month). The total amount you'll get for CCB payments depends on: The number of eligible children in your care.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.