Loading

Get C394 Wage Loss

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the C394 WAGE LOSS online

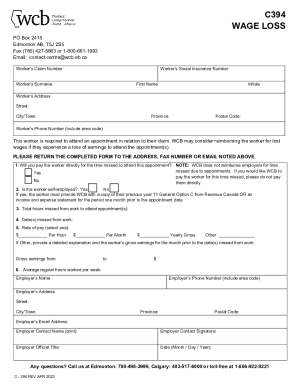

The C394 WAGE LOSS form is designed to facilitate the reimbursement process for workers who experience a loss of wages due to attending appointments related to their claims. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the C394 WAGE LOSS form online.

- Press the ‘Get Form’ button to obtain the C394 WAGE LOSS form and open it in your editing tool.

- Enter the worker's claim number in the designated field at the top of the form.

- Provide the worker's social insurance number in the corresponding field.

- Fill in the worker's surname, first name, and initials as required.

- Complete the worker's address by providing the street, city/town, province, and postal code.

- Include the worker's phone number, ensuring to include the area code.

- Indicate whether the employer will pay the worker directly for the time missed by selecting 'Yes' or 'No' for the relevant question.

- If the worker is self-employed, select 'Yes' or 'No' and attach the required documentation, such as T1 General Option C or an income and expense statement.

- Input the total hours missed from work to attend the appointments.

- List the specific date(s) missed from work due to the appointments.

- Select the worker's rate of pay by checking the appropriate box (per hour, per month, yearly gross, or other) and provide additional details if 'Other' is selected.

- Calculate and provide the gross earnings for the month prior to the dates missed.

- Enter the average regular hours worked per week.

- Provide the employer's contact details, including phone number, name, address, email address, and a printed name of the contact person.

- Ensure the employer contact provides their signature and official title on the form.

- Date the form by entering the month, day, and year.

- Review all information for accuracy and completeness.

- Save any changes made to the form, and proceed to download, print, or share the completed document as needed.

Complete your C394 WAGE LOSS form online today for timely processing.

Working wage loss is payable at two-thirds of the difference between the worker's average weekly wage and their current earnings. Non-working wage loss is paid at two-thirds of the worker's average weekly wage. It is possible to receive both non-working wage loss and working wage loss at the same time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.