Loading

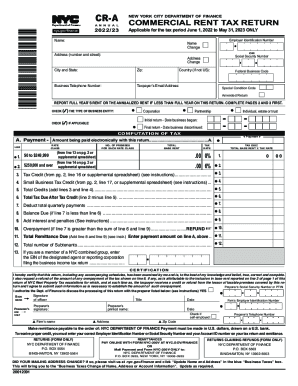

Get Nyc Dof Cr-a 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

tenants This tax is charged to tenants who occupy or use a property for commercial activity in Manhattan, south of the center line of 96th Street and pay at least $250,000 each year in rent. Commercial Rent Tax | City of New York - NYC Business nyc.gov https://nyc-business.nyc.gov › nycbusiness › description nyc.gov https://nyc-business.nyc.gov › nycbusiness › description

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.