Loading

Get Irs 8453-ol 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8453-OL online

Filling out the IRS 8453-OL form is an essential step in verifying your online income tax return. This guide provides a straightforward approach to completing the form to ensure a seamless filing process.

Follow the steps to accurately complete the IRS 8453-OL online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

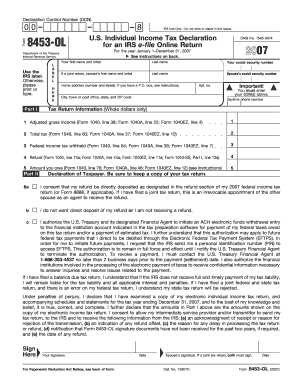

- In the top left corner of the form, enter the Declaration Control Number (DCN), which is a unique 14-digit number provided by your tax preparation software. It starts with '00' followed by your Electronic Filer Identification Number (EFIN), a batch number, a serial number, and the year of filing (e.g., 8 for 2008).

- Complete your personal information by entering your first name, middle initial, last name, and your social security number in the respective fields. If filing a joint return, include your spouse’s details as well.

- Provide your home address, including the street number and name, apartment number (if applicable), city or town, state, and ZIP code.

- Fill in the daytime phone number in the designated area.

- Complete Part I by inputting financial information such as adjusted gross income, total tax, federal income tax withheld, refund amount, and amount owed. Ensure to input whole dollars only.

- In Part II, review the declarations. Check the applicable boxes regarding direct deposit of your refund, and authorizations for payment of federal taxes owed.

- Sign and date the form to certify the accuracy of your information. If filing jointly, ensure both spouses sign the form.

- After completing the form, you may choose to save your changes, download, print, or share the form as needed.

Ensure your online tax filing is accurate and complete by following the steps outlined above to fill out the IRS 8453-OL.

Related links form

Form FTB 8453-OL summarizes your return information, including the amount of money you will receive as a refund or owe. It also shows whether or not you chose to have your refund deposited directly into your bank account or if you decided to pay by electronic funds withdrawal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.