Loading

Get Irs Instruction 706 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 706 online

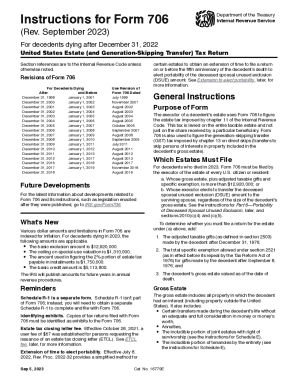

Filling out the IRS Instruction 706 can be a complex process, especially for those without legal expertise. This guide aims to simplify the task by breaking down each section of the form and providing clear, actionable steps to help users complete it accurately and efficiently online.

Follow the steps to fill out IRS Instruction 706 effectively.

- Click the 'Get Form' button to obtain the form and open it in your editor.

- Begin with Part 1 to input the decedent's information. Enter the decedent's full name, Social Security Number (SSN), date of death, and executor's information. Ensure accuracy to avoid processing delays.

- Continue to Part 2, the Tax Computation section. Calculate the tentative estate tax based on the gross estate's value and deductions, and use the tables provided in the instructions to arrive at the correct tax amount.

- Move on to Part 3 to declare any elections by the executor. This includes any decisions regarding alternate valuation or special-use valuation, which can have significant tax implications.

- Complete Parts 4 through 6, which include general information, deductions, and the portability of the deceased spousal unused exclusion (DSUE). Attach any necessary documents, such as certified copies of wills and trusts, as specified in the instructions.

- Review the Recapitulation section (Part 5) where you will summarize all entered values and calculations. Ensure that all fields, even zeros, are accounted for.

- Finalize by completing any remaining schedules (A through O) that are applicable to the estate. Provide thorough descriptions and valuations as required.

- Once all parts are filled out, review the entire document for completeness and accuracy. Click to save changes, and then choose whether to download, print, or share the completed form as required.

Complete your IRS paperwork online today for a smoother filing process.

If you meet all of the following requirements, you are not required to file Form 709. You made no gifts during the year to your spouse. You did not give more than $17,000 to any one donee. All the gifts you made were of present interests.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.