Loading

Get Irs 2290 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2290 online

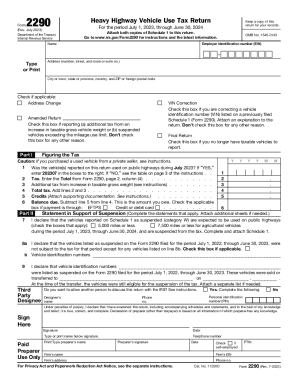

Filling out the IRS Form 2290 online can streamline your filing process for the heavy highway vehicle use tax. This comprehensive guide will walk you through each section of the form, ensuring that you understand every detail needed for a successful submission.

Follow the steps to complete your IRS 2290 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your employer identification number (EIN) in the designated field. This unique number is crucial for identifying your business with the IRS.

- Fill in your name, address, including the city, state, and ZIP code. Ensure that the address is accurate and up-to-date.

- Indicate if any changes apply, such as Address Change or VIN Correction, by checking the appropriate boxes if necessary.

- Next, specify if this is an amended return or a final return by checking the respective boxes. This helps clarify the type of filing.

- In Part I, answer whether the vehicles reported were used on public highways during the specified period. If yes, enter '202307' for July 2023.

- Calculate the total tax owed based on the vehicle's taxable gross weight mentioned in the tables. Input this total in the corresponding line of the form.

- If applicable, add any additional tax from increases in taxable gross weight or for suspended vehicles if exceeding mileage limits.

- Use the section for credits to subtract any eligible amounts from your total tax owed. Make sure to attach any supporting documentation.

- Finalize the balance due by subtracting credits from your total tax. Mark the payment method, whether by EFTPS or credit/debit card.

- In Part II, if reporting suspended vehicles, complete all applicable declarations and attach detailed explanations or additional sheets as necessary.

- Designate a third party if you wish for someone to discuss your return with the IRS by completing the relevant fields provided.

- Sign and date the form, ensuring that the information is true and correct to the best of your knowledge.

- Lastly, save changes, download, print, or share the completed Form 2290 as needed for your records.

Begin your online filing process for the IRS 2290 now to ensure timely submission.

The penalty for failing to file IRS Form 2290 by August 30th is equivalent to 4.5 percent of total tax due, assessed on a monthly basis up to five months. Late filers not making a highway use tax payment also face an additional monthly penalty equal to 0.5 percent of total tax due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.