Get Nyc Dof Nyc-5ub 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF NYC-5UB online

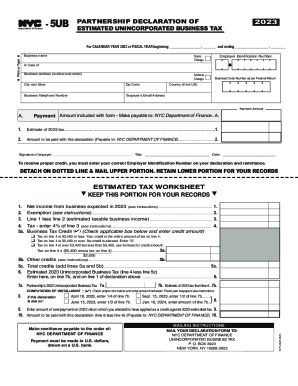

This guide provides a detailed, step-by-step approach to completing the NYC DoF NYC-5UB form online for the estimated unincorporated business tax. Our aim is to equip you with the knowledge necessary to navigate each section of the form with confidence.

Follow the steps to accurately complete your NYC-5UB form.

- Press the ‘Get Form’ button to access the NYC DoF NYC-5UB and open it in your preferred online editor.

- Enter the business name at the top of the form, followed by any changes if applicable. Ensure accuracy to prevent administrative issues.

- Input the business address, including the number and street, city and state, and zip code. This information is essential for identification purposes.

- Provide the Employer Identification Number (EIN) used by your business. This number is critical for tax processing.

- Fill in the business telephone number and the taxpayer’s email address. Keeping this information updated ensures you receive important notices.

- Locate the section for the estimated tax computation. Enter the net income expected from the business for the calendar year, followed by any exemptions.

- Calculate the estimated taxable business income by subtracting the exemption from the net income and enter the result.

- Determine the estimated tax by calculating 4% of the taxable business income. This figure will be used for your estimated tax declaration.

- Review any applicable business tax credits and enter them in the appropriate fields, which may reduce the overall tax liability.

- Once all sections are complete, verify the information for accuracy before proceeding to submit.

- Finally, save your changes, and then download, print, or share the completed form as required for your records or further action.

Complete your NYC-5UB online now to stay compliant with your business tax obligations.

NYC imposes UBT at a rate of 4% on any unincorporated business—that is, any trade or business engaged in or conducted by an individual (sole proprietorship) or unincorporated entity, including a partnership or LLC.

Fill NYC DoF NYC-5UB

You must file the declaration for the calendar year 2025 on or before April 15, 2025, or on the applicable later dates specified in these instructions. Part-year residents receive a partial credit. NYC-5UB. Partnership Declaration of Estimated Unincorporated Business Tax ; NYC-5UBTI. No payments are required for Form NYC-204-EZ. FORM NYC-5UB - Partnership Declaration of. Welcome to the official website of the NYS Department of Taxation and Finance. To the preparer and prints Form NYC-5UB. • Automatically calculates and limits the Business Tax Credit. (A partner- ship declaration should be filed on Form. The document is a declaration form for the estimated Unincorporated Business Tax (UBT) for partnerships in New York City for the calendar year 2018.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.