Loading

Get Irs 1094-c 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1094-C online

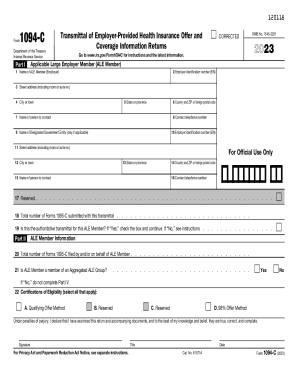

The IRS 1094-C is a vital form for applicable large employers to report information about health insurance coverage offered to employees. This guide provides a detailed, step-by-step approach to filling out the form online.

Follow the steps to fill out the IRS 1094-C online accurately.

- Click ‘Get Form’ button to obtain the IRS 1094-C form and open it in your editor.

- Begin with Part I. Enter the name of the applicable large employer (ALE) member in box 1 and the employer identification number (EIN) in box 2. Ensure that the street address, city, state, and ZIP code are accurate in boxes 3 to 6.

- In box 7, provide the name of the person to contact regarding the form, and include their telephone number in box 8. If a designated government entity applies, fill in their information in boxes 9 and 10, including the EIN and address.

- Continuing in Part I, ensure 'Total number of Forms 1095-C submitted' is correct in box 18. In box 19, indicate whether this is the authoritative transmittal by checking the box accordingly.

- Proceed to Part II. Enter the total number of Forms 1095-C filed on behalf of the ALE member in box 20. In box 21, indicate whether the ALE member is part of an Aggregated ALE Group by selecting 'Yes' or 'No.' Complete the certifications in box 22 as applicable.

- In Part III, fill out the monthly information regarding minimum essential coverage offers. Provide the full-time employee count for the ALE member in column (b) and the total employee count in column (c) for each month.

- If applicable, complete Part IV by listing the names and EINs of other ALE members in the aggregated ALE group.

- Before finalizing, review the entire form for accuracy. Enter your signature, the date, and title where prompted.

- Once all fields are completed, save your changes. You can download, print, or share the form as necessary.

Complete your IRS 1094-C form online with confidence today!

Employers with 50 or more full-time employees (including full-time equivalent employees) in the previous year use Forms 1094-C and 1095-C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.