Loading

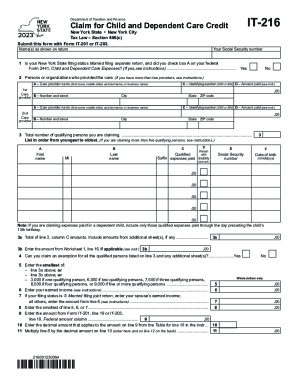

Get Form It-216 Claim For Child And Dependent Care Credit Tax Year 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-216 Claim For Child And Dependent Care Credit Tax Year 2023 online

Filling out the Form IT-216 Claim for Child and Dependent Care Credit for the tax year 2023 is essential for individuals seeking to claim credit for qualifying childcare expenses. This guide provides clear, step-by-step instructions to assist users in completing the form online with ease.

Follow the steps to successfully complete your claim.

- Click ‘Get Form’ button to obtain the form and open it in your document editor.

- In the first section, provide your name as it appears on your tax return and enter your Social Security number.

- Indicate your New York State filing status by answering the question regarding whether you are filing as married separately and if you checked box A on your federal Form 2441.

- List the persons or organizations that provided care for your qualifying dependents. You need to provide the care provider's name, address, identifying number (SSN or EIN), and the amount paid to them.

- State the total number of qualifying persons you are claiming and list their names in order from youngest to oldest. Ensure to include their Social Security numbers and dates of birth.

- Tally the amounts from column C for each qualifying person and enter it on line 3a. If applicable, also include amounts from additional sheets.

- Assess if you can claim an exemption for all the qualified persons listed.

- On line 5, enter the smallest value among the total expenses from line 3a, line 3b, or the specified amounts based on the number of qualifying persons.

- Input your earned income on line 6 and your spouse’s earned income, if applicable, on line 7.

- Determine the smallest of line 5, line 6, or line 7 to record on line 8.

- Complete lines 9 through 11 to calculate your New York State child and dependent care credit.

- If you are a part-year resident, enter the amounts as instructed for the applicable lines 15 through 22.

- If you were a New York City resident, complete lines 23 through 29 for the New York City child and dependent care credit.

- Finally, review your entries for accuracy. Save your changes, and when ready, download, print, or share the completed form as needed.

Complete your Form IT-216 online today to ensure you claim your eligible credits efficiently.

If you file as single or head of household and make less than $200,000, you can claim a $2,000 Child Tax Credit (CTC) (tax year 2023) for each qualifying child. Up to $1,500 of the CTC is refundable for 2023 through the Additional Child Tax Credit for qualifying families.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.