Loading

Get Form It-256 Claim For Special Additional Mortgage ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-256 Claim For Special Additional Mortgage Recording Tax Credit online

Filling out the Form IT-256, Claim For Special Additional Mortgage Recording Tax Credit, can be straightforward when you follow the right steps. This guide provides clear, step-by-step instructions to help you complete the form online, ensuring that you capture all necessary information accurately.

Follow the steps to complete the Form IT-256 online.

- Press the ‘Get Form’ button to access the form and open it in your browser.

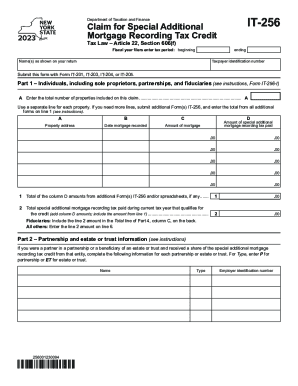

- In the section labeled 'Name(s) as shown on your return', enter the name of the individual or entity submitting the form. This should match the name used in your tax return.

- Proceed to Part 1, where you will input the total number of properties related to this claim. Write the number in the provided field labeled 'A'. Make sure to use a separate line for each property.

- For each property, complete the fields under Part 1: provide the property address, the date the mortgage was recorded, the amount of the mortgage, and the amount of special additional mortgage recording tax paid.

- In Part 2, if applicable, input the partnership or estate/trust information if you were a partner or a beneficiary. Enter the type (P for partnership, ET for estate or trust) along with the name and employer identification number.

- For Part 4, enter the beneficiary's name, identifier, and share of the special additional mortgage recording tax. Calculate the total credit available based on the information from previous sections.

- Part 6 allows you to compute the credit used and any remaining credits. Follow the instructions carefully to determine the tax due, credits applied, and the net amount.

- Once you have reviewed all fields, save your changes, download the completed form, and prepare to submit it along with any required documents.

Start filling out your Form IT-256 online today to take advantage of the special additional mortgage recording tax credit.

The mortgage recording tax requires purchasers to pay 1.8% on mortgage amounts under $500,000 and 1.925% on mortgage amounts above $500,000 in NYC (this includes the recording tax for both New York City and New York State). NY state imposes a mortgage tax rate of 0.5%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.