Loading

Get Ny It-221 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-221 online

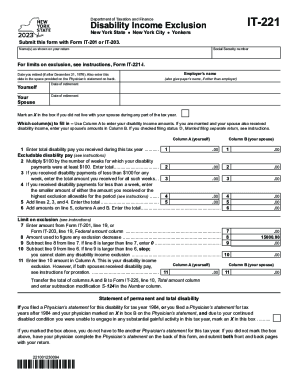

The NY IT-221 form is used to claim a disability income exclusion for eligible individuals in New York State. This guide provides clear, step-by-step instructions on how to accurately complete the form online, ensuring you maximize your allowable deductions.

Follow the steps to successfully complete the NY IT-221 form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online tool.

- Enter your name(s) as shown on your tax return in the designated field at the top of the form.

- Provide your social security number in the space provided to uniquely identify your tax record.

- Indicate the date you retired if it was after December 31, 1976. Ensure you also enter this date in the space provided on the Physician’s statement located on the back of the form.

- If applicable, enter the name of your employer and, if different, the payer's name. Specify the dates of retirement for both you and your spouse if they also retired.

- If there are periods during the tax year when you did not live with your spouse, mark the box provided for that information.

- Fill in Column A with the total disability pay you received during the tax year. Follow the instructions closely for calculating the amounts and complete the subsequent lines as directed.

- If your spouse received disability pay, fill in Column B with the total amounts received by them, using the same structure as for your own figures.

- Complete the calculations for the limits on exclusion by referring to the specific lines outlined in the form and the accompanying instructions. Be attentive to the limitations based on your total amounts.

- Transfer the final total from both columns to Form IT-225, ensuring you enter the subtraction modification where indicated.

- If required, have your physician complete the Physician’s statement on the back of the form. File both pages of the IT-221 with your tax return.

- After finalizing the entries, make sure to save your changes, and you can download, print, or share the form based on your needs.

Begin filling out your NY IT-221 form online today to maximize your available deductions.

Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year. It can be described broadly as adjusted gross income (AGI) minus allowable itemized or standard deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.