Loading

Get Ny It-261 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-261 online

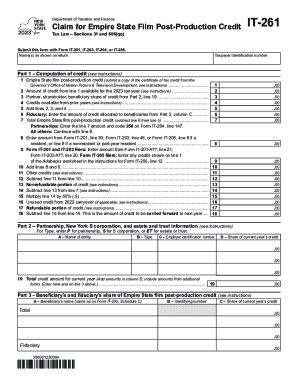

The NY IT-261 is a form used to claim the Empire State film post-production credit. This guide provides clear, step-by-step instructions on how to accurately fill out the form online, making the process easier for individuals and entities eligible for this credit.

Follow the steps to successfully complete the NY IT-261

- Click 'Get Form' button to obtain the NY IT-261 and open it in the editor.

- In the first section, enter the name(s) as shown on your tax return along with your taxpayer identification number.

- Proceed to Part 1 – Computation of credit. Here, you will calculate the Empire State film post-production credit by following the instructions provided.

- Line 1 requires you to submit a copy of the certificate of tax credit from the Governor’s Office of Motion Picture & Television Development. Ensure this document is ready to be attached, if necessary.

- Continue to fill in lines 2 through 7. Calculate and input the amounts from your 2023 tax year available credit, partner or shareholder shares, and any credits from prior years as indicated in the instructions.

- In Part 2, provide information about your partnership, S corporation, or estate and trust. Complete each field, including entity name, type, employer identification number, and current year credit shares.

- Part 3 focuses on the beneficiary’s and fiduciary’s share of the Empire State film post-production credit. Fill in the beneficiary’s name, identifying number, and their share of the current year's credit.

- In Part 4, indicate the amount of credit to be claimed in succeeding tax years for 2024 and 2025, following the provided instructions.

- After all sections are completed, review the form for accuracy and completeness. You can then save changes, download, print, or share the completed form as needed.

Complete your NY IT-261 form online today to ensure timely submission for your post-production credit.

To encourage companies to post their film projects in New York and help create and maintain film industry jobs, productions which comply with requirements may be eligible for a fully refundable tax credit of 30% of qualified post-production expenses. This tax credit program is funded at $45 million a year through 2034.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.