Loading

Get Ny It-203-gr-att-b 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-203-GR-ATT-B online

Filling out the NY IT-203-GR-ATT-B form online is a straightforward process that helps ensure accurate reporting for nonresident partners in a Yonkers group return. This guide provides clear, step-by-step instructions to assist users in completing the form with confidence.

Follow the steps to successfully complete your form.

- Click the ‘Get Form’ button to access the NY IT-203-GR-ATT-B form and open it in the editor.

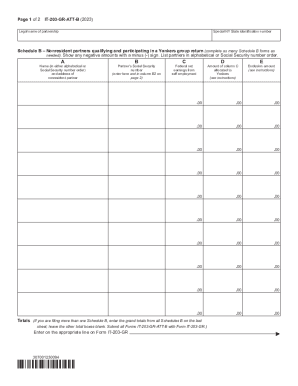

- Begin by entering the legal name of the partnership and the special NY State identification number at the top of the form.

- Proceed to Schedule B. Fill in the names and addresses of nonresident partners in either alphabetical order or order by their Social Security numbers in column A.

- In column B, enter each partner’s Social Security number. Ensure that the number entered here matches the one on page 2 in column B2.

- In column C, record the federal net earnings from self-employment for each partner.

- Next, complete column D by allocating any amounts from column C to Yonkers as instructed.

- Fill out column E with any exclusion amounts as specified in the instructions.

- At the end of Schedule B, calculate and enter the totals from all Schedule B forms on the last sheet, leaving blank the other total boxes.

- On page 2, repeat entering the legal name of the partnership. Then, reaffirm the Social Security numbers in column B2.

- Continue by calculating Yonkers taxable earnings in column F by subtracting column E from column D.

- In column G, compute the Yonkers nonresident earnings tax by multiplying the amount in column F by .005.

- Record the Yonkers estimated income tax paid in column H, which is the amount paid with Form IT-370.

- Calculate the balance due in column I by subtracting the amount in column H from column G.

- Finally, determine any overpayment in column J by subtracting column H from column G.

- Once the form is completely filled out, save your changes, and choose to download, print, or share the completed NY IT-203-GR-ATT-B form.

Complete your documents online now for a seamless filing experience.

The pass-through entity tax must be paid by a partnership or New York S corporation to another jurisdiction on income derived from that jurisdiction and subject to tax under Article 22. This includes any taxes paid by an LLC treated as a partnership or S corporation for New York State tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.