Loading

Get Ny It-203-b 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-203-B online

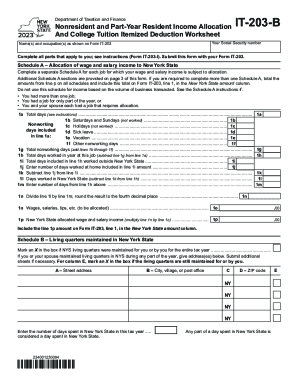

The NY IT-203-B form is a key document for nonresidents and part-year residents seeking to allocate their income effectively. This guide provides clear instructions on how to complete the form online, ensuring that you adhere to all required guidelines accurately.

Follow the steps to fill out the NY IT-203-B form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security number as prompted. Ensure the number matches your official documents.

- Read the instructions carefully to identify which parts apply to your situation. Make sure to fill out all relevant sections.

- For Schedule A, complete a separate allocation for each job where wages are subject to allocation. Follow the prompts to indicate total days, nonworking days, and days worked in New York State.

- In Schedule B, indicate if you maintained living quarters in New York State throughout the tax year. Enter any relevant addresses.

- When reaching Schedule C, determine if you are claimed as a dependent. If not, continue to fill in the details for any eligible students.

- After completing all sections, review your entries for accuracy. Make any necessary adjustments before submitting.

Start filling out your NY IT-203-B form online today!

Generally, you must file a New York State income tax return if you are a New York State resident and are required to file a federal return. You may also have to file a New York State return if you are a nonresident of New York and you have income from New York State sources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.