Loading

Get Irs 1040 - Schedule 2 (sp) 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

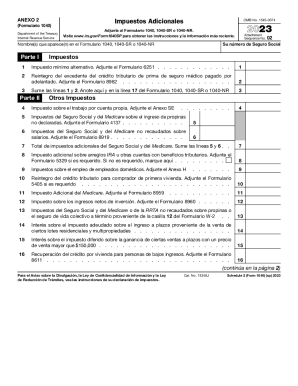

Schedule 2: Supporting documentation for tax form 1040 if box 11b is checked. This Schedule is used to report additional taxes owed such as the alternative minimum tax, self-employment tax, or household employment taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.