Loading

Get Irs 3903 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 3903 online

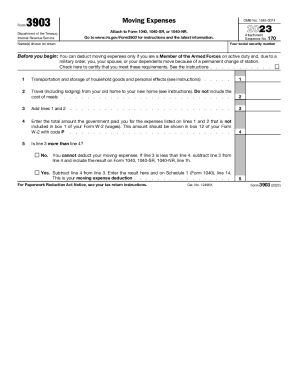

The IRS 3903, also known as the Moving Expenses form, is essential for eligible Armed Forces members to claim deductions on qualifying moving expenses. This guide will walk you through the process of completing the form online, ensuring a smooth filing experience.

Follow the steps to complete the IRS 3903 online

- Press the ‘Get Form’ button to access the IRS 3903 and open it in your preferred editing tool.

- Enter your social security number on the designated line. This step is crucial for identifying your tax records.

- Provide your name as it appears on your tax return. Make sure to enter it accurately to avoid discrepancies.

- Check the box to certify that you meet the requirements to deduct moving expenses, confirming that you are an active duty member of the Armed Forces moving due to a military order.

- In line 1, input the total amount for transportation and storage of household goods and personal effects, as per the instructions.

- On line 2, record the travel expenses, including lodging costs from your old home to your new home. Note that meal costs should not be included.

- Add the amounts from lines 1 and 2 and place the total on line 3.

- On line 4, enter the total amount reimbursed by the government for the same expenses, ensuring it is not included in your Form W-2 box 1.

- Evaluate whether line 3 is greater than line 4. If yes, subtract line 4 from line 3 and record the result, which represents your moving expense deduction, on Schedule 1 (Form 1040), line 14.

- If line 3 is less than or equal to line 4, you cannot deduct your moving expenses. Follow the provided instructions accordingly.

- Once all entries are complete, save your changes, download the form, and print it out for your records or to attach it to your tax return.

Start filling out the IRS 3903 online today to ensure you claim your eligible moving expense deductions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A moving expense that qualifies as tax-deductible must be purchased during the moving process. Examples of such expenses include storage units, lodging, gas and other expenses that might arise while packing your personal belongings and moving them to a new location.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.