Loading

Get Irs W-8exp 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-8EXP online

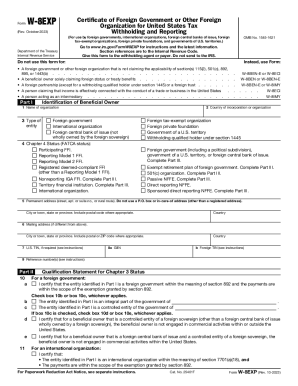

The IRS W-8EXP form is a crucial document for foreign governments and organizations to certify their status for U.S. tax withholding purposes. This guide will provide step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and access it in an online format.

- In Part I, provide the name of the organization in the designated field. This should be the full legal name of the entity.

- Enter the country of incorporation or organization in the next field, ensuring that it matches official records.

- Select the type of entity by checking the appropriate box: foreign government, international organization, or foreign central bank of issue, among others.

- Complete the Chapter 4 Status (FATCA status) section by selecting the relevant option that describes the entity’s compliance status.

- Fill in the permanent address, ensuring that you do not use a P.O. box. Include the street address, city or town, state or province, postal code, and country.

- If applicable, provide the mailing address in the designated field, and ensure it differs from the permanent address if necessary.

- Input the U.S. TIN if required. If the organization does not have one, this field can be left blank.

- Enter the GIIN, if applicable, and provide any foreign TIN as required by the form instructions.

- Proceed to Part II, where you will certify the qualification statement related to Chapter 3 status. Check the boxes that apply based on your entity's characteristics.

- Complete the necessary fields in Part III regarding Chapter 4 status, if applicable, by selecting the correct options that pertain to your entity.

- In Part IV, sign the form as an authorized official. Enter your printed name, title, and the date. Ensure all information is accurate and representative of the entity.

- Save any changes, then download or print the completed form for distribution to the relevant withholding agent or payer.

Complete your IRS W-8EXP form online today to ensure compliance and streamline tax reporting.

Related links form

W-8BEN is an IRS form used by individual nonresident aliens (NRA) to report information to withholding agents, payers, or FFIs if they are the beneficial owner of an amount from U.S. sources subject to income tax withholding or the NRA account holder at a foreign financial institution (FFI).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.