Loading

Get Ny It-135 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-135 online

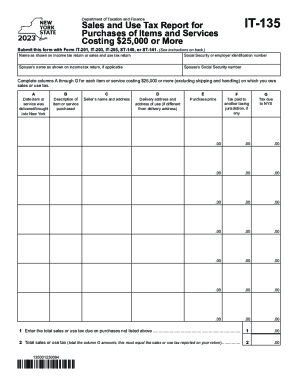

The NY IT-135 form is essential for reporting sales and use tax on significant purchases. This guide provides a detailed, step-by-step approach to help users complete the form accurately and efficiently online.

Follow the steps to fill out the NY IT-135 form successfully.

- Press the ‘Get Form’ button to obtain the NY IT-135 form and access it in the document viewer.

- Enter your name and Social Security number or employer identification number exactly as they appear on your tax return. If applicable, include your partner's name and Social Security number.

- Complete columns A through G for each item or service costing $25,000 or more that you owe sales or use tax on, excluding shipping and handling. Start with column A and fill in the date the item or service was delivered into New York.

- In column B, provide a clear description of the item or service purchased.

- Enter the seller's name and address in column C. If you made an online purchase, include the seller's website address as well.

- Input the delivery address in column D and, if it differs, the address where the item or service will be used.

- In column E, indicate the purchase price of the item or service as documented.

- If applicable, detail any tax paid to another jurisdiction in column F.

- In column G, calculate and enter the tax due to New York State.

- For any additional purchases costing less than $25,000 each, enter the total sales or use tax due on line 1.

- Total the amounts in column G and enter this on line 2; ensure this matches the tax reported on your income tax return.

- Save your changes, download, print, or share the form as needed.

Start completing your documents online today for a seamless experience.

There are nine income tax brackets in New York: 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%. Each one corresponds to a bracket of income, which varies depending on filing status. The highest tax bracket only applies to incomes greater than $25 million.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.