Loading

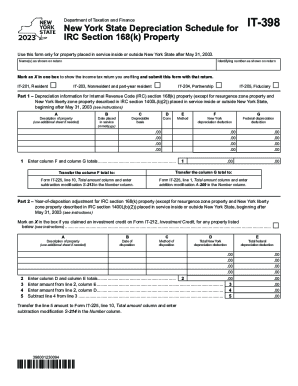

Get Form It-398 New York State Depreciation Schedule For Irc Section 168(k) Property Tax Year 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-398 New York State Depreciation Schedule For IRC Section 168(k) Property Tax Year 2023 online

Filling out the Form IT-398 is crucial for accurately reporting depreciation for properties placed in service in New York State. This guide provides clear, step-by-step instructions to help users navigate the form online and ensure compliance with tax regulations.

Follow the steps to accurately complete the Form IT-398 online.

- Use the ‘Get Form’ button to access the form and open it in your editor of choice.

- Enter your name and identifying number as shown on your tax return in the designated fields.

- Select the appropriate box to indicate which income tax return you are filing, such as IT-201 for residents or IT-203 for non-residents.

- In Part 1, provide the depreciation information for your IRC Section 168(k) property: enter the description of the property and the date it was placed in service.

- Fill in the depreciable basis of the property in Column C, followed by the applicable convention in Column D, and the depreciation method in Column E.

- Calculate and enter the New York depreciation deduction in Column F and the federal depreciation deduction in Column G.

- Transfer the total amounts from Columns F and G as instructed to the appropriate form lines.

- In Part 2, mark the box if you claimed an investment credit and provide details of the property being disposed of, as well as the date of disposition.

- Complete Column D with the total New York depreciation deduction and Column E with the total federal depreciation deduction for disposed properties.

- Make any necessary adjustments and ensure all entries are accurate before saving your form.

- Once completed, you can save your changes, download, print, or share the form as needed.

Take the first step towards accurate tax reporting by completing your Form IT-398 online today.

The rules allow Bonus Depreciation to 100% for all qualified purchases made between September 27, 2017 and January 1, 2023. Bonus Depreciation now ramps down to 80%, starting in 2023. Bonus depreciation will continue to ramp down for ensuing years: 60% for 2024, 40% for 2025, 20% for 2026, and 0% beginning in 2027.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.