Loading

Get Irs 8752 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8752 online

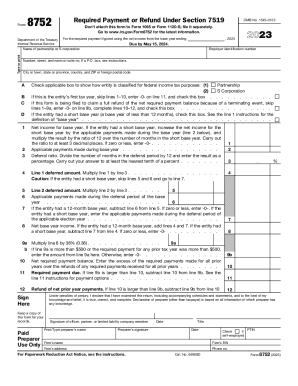

Filing IRS Form 8752 is essential for partnerships and S corporations that have made an election under section 444 to report required payments or claim refunds. This guide provides a clear, step-by-step approach to completing the form online for a smooth filing process.

Follow the steps to complete IRS Form 8752 online.

- Use the ‘Get Form’ button to access the form and open it in the editor.

- Enter the name of the partnership or S corporation in the designated field. Make sure to type or print clearly.

- Provide the employer identification number (EIN) associated with the entity.

- Complete the address section, including the number, street, city, state, and ZIP code. If using a P.O. box, follow the specific instructions provided.

- Check the appropriate box to indicate how the entity is classified for federal income tax purposes — either as a partnership or an S corporation.

- If this is the entity’s first tax year, check the specified box and enter -0- on line 11.

- For a terminating event claiming a full refund, skip lines 1–9a, enter -0- on line 9b, complete lines 10–12, and check the corresponding box.

- If the entity had a short base year (less than 12 months), check the applicable box.

- Calculate the net income for the base year and enter it in the specified line, following instructions for adjustments if necessary.

- Identify and enter applicable payments made during the base year.

- Calculate the deferral ratio based on the deferral period and enter the resulting percentage.

- Complete the deferred amount calculations and check whether the entity's base year is 12 months or short.

- Enter the calculated amounts for net required payment balance and required payment due based on the guidelines provided.

- Sign and date the form at the bottom, ensuring to include the title if applicable.

Complete your IRS 8752 filing online today to ensure compliance and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Form 3911 is completed by the taxpayer to provide the Service with information needed to trace the nonreceipt or loss of the already issued refund check.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.