Loading

Get Irs 990-t 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990-T online

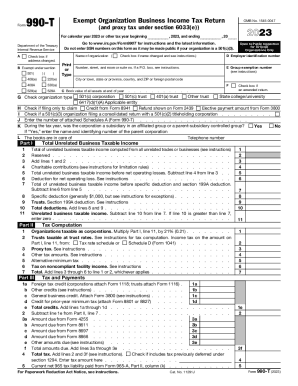

The IRS 990-T form, also known as the Exempt Organization Business Income Tax Return, is essential for organizations that have generated unrelated business taxable income. This guide provides clear, step-by-step instructions for filling out the form online, ensuring that users can navigate the process efficiently and accurately.

Follow the steps to complete your IRS 990-T form online.

- Press the ‘Get Form’ button to acquire the form and open it in your editor.

- Begin by entering the organization’s name and employer identification number in fields D and E, respectively. If the organization name has changed, check the corresponding box.

- Provide the organization's address, ensuring to include the city, state, and ZIP code accurately.

- Indicate the type of organization by checking the appropriate box. This could include options like a 501(c) corporation or a state college.

- In Part I, list all relevant income and deductions. Pay attention particularly to line 10, where you might need to compute unrelated business taxable income.

- Proceed to Part II to compute the tax amount based on the unrelated business taxable income from Part I.

- In Part III, document any payments made and calculate if a tax due or overpayment exists.

- Complete Part IV by answering questions regarding the organization’s financial accounts, particularly concerning any international holdings.

- After thoroughly completing all sections, review the information for accuracy.

- Finally, save your changes, download the completed form, or print it for submission.

Take the next step in managing your documents by completing your IRS 990-T form online today.

Exempt organizations use Form 990-T to: Report unrelated business income. Figure and report unrelated business income tax liability. Report proxy tax liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.