Loading

Get Irs 4952 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4952 online

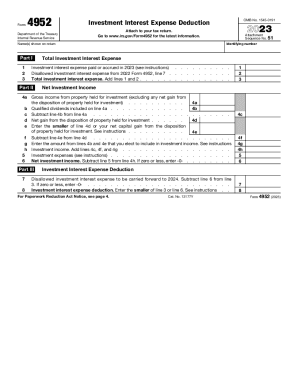

The IRS 4952 form is used to determine the amount of investment interest expense you can deduct for the tax year. This guide will provide a clear, step-by-step approach to help you complete the form online effectively and accurately, ensuring you maximize your allowable deductions.

Follow the steps to complete the IRS 4952 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter your total investment interest expense for 2023 in line 1. This includes any interest paid or accrued on loans used for investment purposes.

- In line 2, report any disallowed investment interest expense from your previous year's Form 4952.

- Add lines 1 and 2 together in line 3 to get your total investment interest expense.

- Proceed to Part II. In line 4a, enter the gross income from property held for investment, excluding any net gain.

- Fill in line 4b with the portion of dividends that qualify. Then, subtract line 4b from line 4a and document the result in line 4c.

- Record any net gain from the disposition of investment property in line 4d. If applicable, enter your net capital gain in line 4e.

- In line 4g, elect to include any qualified dividends and net capital gains in your investment income if you wish.

- Sum up the results in line 4h for your total investment income and list any investment expenses in line 5.

- Deduct the investment expenses from your total investment income in line 6 to determine your net investment income for the year.

- Move on to Part III. Subtract line 6 from line 3 in line 7 to find any disallowed investment interest expense to carry forward.

- Finally, in line 8, enter the smaller of line 3 or line 6 to determine your investment interest expense deduction.

- Once you have completed all sections, you can save changes, download, print, or share the form as needed.

Complete your IRS 4952 Form online today to ensure you maximize your investment interest deductions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

IRS Form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward. The form must be filed by individuals, estates, or trusts seeking a deduction for investment interest expenses.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.