Loading

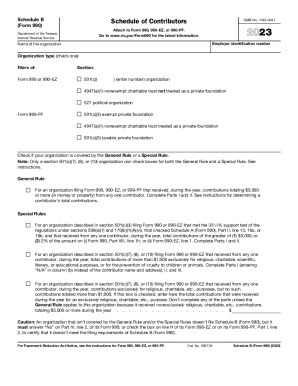

Get 2023 Schedule B (form 990). Schedule Of Contributors

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Schedule B (Form 990). Schedule Of Contributors online

This guide provides comprehensive instructions on completing the 2023 Schedule B (Form 990), known as the Schedule of Contributors. Whether you are a newcomer or familiar with the process, this step-by-step walkthrough will help ensure your form is accurately filled out and submitted online.

Follow the steps to successfully complete Schedule B online.

- Press the ‘Get Form’ button to access the Form 990 Schedule B and initiate the editing process.

- Complete the top section of the form by entering your organization's employer identification number and name. Indicate the type of organization by checking the appropriate box.

- Select if your organization falls under the General Rule or one of the Special Rules. Most organizations that received $5,000 or more in the tax year must complete Parts I and II.

- Move to Part I and begin listing each contributor. Start with the first contributor's number and name in column (b) followed by their total contributions in column (c) and the type of contribution in column (d).

- If you have noncash contributions, complete Part II by referencing the contributor number from Part I. Describe the noncash property and document its fair market value (FMV) in the respective columns.

- If applicable, navigate to Part III for organizations under sections 501(c)(7), (8), or (10). Provide detailed information for contributors whose total contributions exceeded $1,000.

- Review all sections for accuracy. Ensure you have documented all required contributions and have not included any contributor's social security numbers.

- Once you are satisfied with the completed form, save the changes. You may choose to download and print a copy for your records, or share it as needed.

Complete your documentation process by ensuring all necessary forms are accurately filled online.

Understanding the Form 990 Schedule B Schedule B requires you to disclose donors who contributed more than $5,000 or an amount larger than 2% of your total donation revenue in the past fiscal year. In other words, it asks nonprofits to disclose the names and contact information of their mid-level and major donors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.