Loading

Get Irs 1040 Schedule J 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule J online

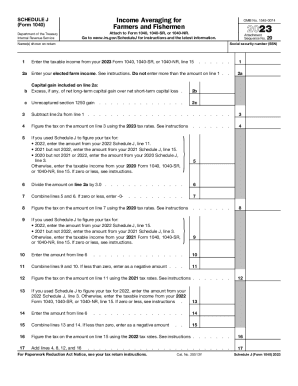

Filling out the IRS 1040 Schedule J form can help farmers and fishermen with income averaging. This guide will provide you with clear, step-by-step instructions on how to complete this form online for accurate tax reporting.

Follow the steps to effectively complete your IRS 1040 Schedule J online.

- Click ‘Get Form’ button to obtain the form and open it in the digital editor.

- Enter your social security number (SSN) and the name(s) shown on your tax return at the top of the form.

- On line 1, enter the taxable income from your 2023 Form 1040, 1040-SR, or 1040-NR, line 15.

- On line 2a, input your elected farm income, ensuring it does not exceed the amount on line 1.

- If applicable, provide any capital gain details on line 2b and line 2c as directed in the instructions.

- Calculate the difference by subtracting line 2a from line 1 and record it on line 3.

- Determine the tax on the amount from line 3 using the 2023 tax rates and enter that figure on line 4.

- On line 5, based on your previous years' Schedule J usage, enter the relevant amounts as described.

- Calculate line 6 by dividing the amount on line 2a by 3.0.

- Combine the values from lines 5 and 6, entering the result on line 7.

- Determine the tax on the amount from line 7 using the 2020 tax rates and place it on line 8.

- Follow similar instructions as in previous steps for lines 9 through 22, ensuring to input any required information and calculations.

- Once all calculations and entries are complete, review the form for accuracy before proceeding.

- You can save changes, download, print, or share the completed form as needed from the online editor.

Complete your IRS 1040 Schedule J online to streamline your income averaging process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Electing to use Schedule J to average your income allows you to balance your current tax rate with the rates from previous years, so you're not taxed at a significantly higher rate in the current year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.