Loading

Get Irs 4720 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4720 online

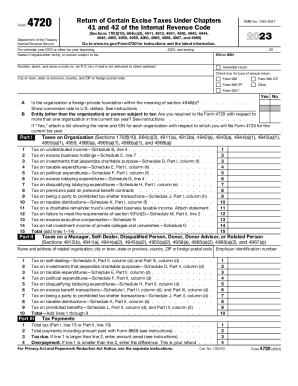

The IRS 4720 form is used to report certain excise taxes under chapters 41 and 42 of the Internal Revenue Code. This guide provides step-by-step instructions to help individuals and organizations complete the form correctly and efficiently online.

Follow the steps to fill out the IRS 4720 accurately.

- Press the ‘Get Form’ button to obtain the IRS 4720 form, which will open in your preferred online editor.

- Begin by filling in the 'Name of organization, entity, or person subject to tax' field at the top of the form, ensuring you correctly identify the subject of the tax.

- Next, provide the Employer Identification Number (EIN) or Social Security Number (SSN) associated with the entity or individual.

- Complete the address section, including the number, street, city, state, and ZIP or foreign postal code.

- Indicate whether this is an amended return by checking the appropriate box.

- Select the type of annual return by checking the corresponding box for Form 990, Form 990-EZ, Form 990-PF, Form 5227, or 'Other.'

- In the next section, answer 'Yes' or 'No' to whether the organization is a foreign private foundation, as per section 4948(b).

- If applicable, include the conversion rate to U.S. dollars as instructed.

- If you are required to file Form 4720 for more than one organization, check 'Yes,' and attach a list with the names and EINs of each organization.

- Proceed to Part I and fill out the taxes on the organization, ensuring to input correct amounts for each tax category.

- Continue to complete Part II for taxes applicable to managers and other individuals involved with the organization.

- Finally, sum up the total tax amounts and include them in the designated sections at the bottom of the form.

- After filling out the entire form, review all entries for accuracy. Once completed, save your changes, and you can download, print, or share the form as needed.

Complete your IRS 4720 form online today to ensure compliance with tax requirements.

Form 4720, Return of Certain Excise Taxes on Charities and Other Persons Under Chapters 41 and 42 of the Internal Revenue CodePDF, is intended primarily for use with Form 990-PF and provides for figuring and reporting the initial taxes imposed under sections 4941, 4942, 4943, 4944 and 4945 on private foundations, ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.