Loading

Get Irs 1040 - Schedule Eic 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule EIC online

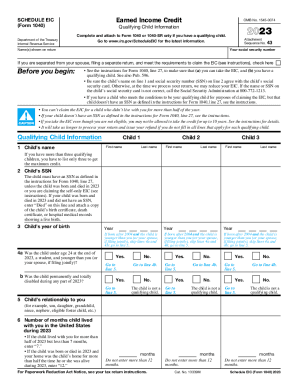

Filling out the IRS 1040 - Schedule EIC can be straightforward with the right guidance. This document is essential for individuals claiming earned income credit and provides necessary information about qualifying children. Follow the steps below to complete the form accurately.

Follow the steps to complete the IRS Schedule EIC with ease.

- Click the ‘Get Form’ button to access the IRS Schedule EIC form online and open it for editing.

- Enter your social security number in the specified field at the top of the form.

- Input the names of those shown on your return.

- If you are separated from your spouse and are filing a separate return, check the box to confirm eligibility for claiming the EIC.

- Provide accurate information for each qualifying child, starting with the child’s name, ensuring it matches their social security card.

- Fill in the child’s social security number, or enter ‘Died’ if the child was born and died in 2023, attaching the required documentation as instructed.

- Indicate the year of birth for each qualifying child.

- Answer the questions regarding the child’s age, student status, and disability status as appropriate, guiding you to the next relevant step.

- Specify the relationship of each child to you in the provided field.

- Indicate the number of months each child lived with you in the United States during 2023, ensuring it does not exceed 12 months.

- Review all entries for accuracy before finalizing the form.

- Once all sections are complete, you can save your changes, download, print, or share the completed form as necessary.

Complete your forms online to ensure a smooth filing process and maximize your earned income credit.

Basic Qualifying Rules To qualify for the EITC, you must: Have worked and earned income under $63,398. Have investment income below $11,000 in the tax year 2023. Have a valid Social Security number by the due date of your 2023 return (including extensions)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.