Loading

Get Form Dtf-4 Offer In Compromise For Liabilities ... - Tax.ny.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form DTF-4 Offer In Compromise For Liabilities ... - Tax.NY.gov online

Completing the Form DTF-4 Offer In Compromise for liabilities is an important step towards resolving tax liabilities efficiently. This guide will provide you with comprehensive, step-by-step instructions for filling out the form online, ensuring you meet all necessary requirements and deadlines.

Follow the steps to fill out the Form DTF-4 Offer In Compromise.

- Press the ‘Get Form’ button to access the form and open it in your chosen editor.

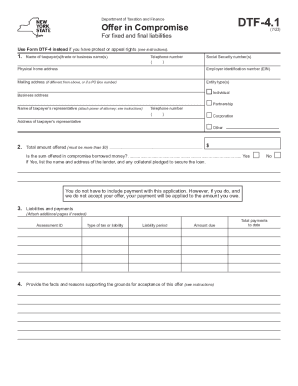

- Enter the name of the taxpayer(s) or trade/business name in the designated field. Include the telephone number and Social Security number(s) or Employer Identification Number (EIN) as required.

- Indicate the physical home address as well as the mailing address if it differs from the physical address. Mark the appropriate entity type(s) such as Individual, Partnership, or Corporation.

- Provide the total amount you are offering. Ensure that the amount is greater than $0 and specify if any portion of this amount is borrowed, supplying the lender's name and any collateral if applicable.

- List all unpaid liabilities you wish to compromise. Include the assessment ID, type of tax or liability, liability period, and amount due for each entry. Attach additional pages if needed.

- In this section, detail the facts and reasons that support your offer. Attach supporting documentation as necessary.

- Thoroughly read and understand the conditions of the offer before signing. Make sure you agree to all terms outlined, including the implications of acceptance.

- Sign and date the form. If applicable, ensure that all necessary signatures are provided for joint tax liabilities.

- Prepare to submit the form with all required supporting documents, including Form DTF-5. Review your submission to ensure compliance with all requirements.

- Finally, save your changes, download or print a copy of the filled form for your records, or share it as needed.

Complete the Form DTF-4 Offer In Compromise online today to take a significant step toward resolving your tax liabilities.

New York State Department of Tax & Finance (NY DTF) is the tax agency that manages and collects tax revenues to support New York State services and programs. To set up your state tax, here's how: Add your New York employee's information. Set up New York State Tax Information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.