Loading

Get Cd Form-iii

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CD Form-III online

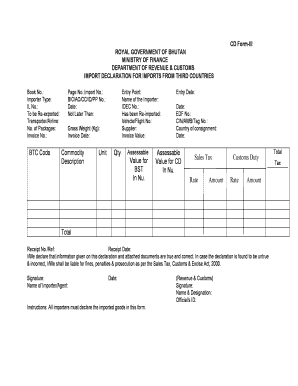

The CD Form-III is essential for declaring imports from third countries to the Royal Government of Bhutan. This guide provides clear instructions on how to accurately complete and submit this form online.

Follow the steps to successfully fill out the CD Form-III online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling in the book number in the designated field, providing the specific number associated with your import shipments.

- Select the importer type from the available options to indicate the nature of your business.

- Fill in your Import License (IL) number accurately to comply with import regulations.

- If applicable, indicate if the goods are to be re-exported by marking the appropriate section.

- Provide the details of the transporter or airline responsible for shipping the goods.

- Enter the total number of packages being imported.

- Input the invoice number associated with your transactions for reference.

- Include the BTC code if required for your specific import type.

- Fill in the page number and import number as instructed.

- Specify the relevant BIC/AC/CC/ID/PP number for customs identification.

- Indicate the date of import declaration using the provided date field.

- Ensure the entry point is accurately noted for customs processing.

- Provide the full name of the importer to establish ownership of the goods.

- Include your IDEC number in the corresponding field, if applicable.

- If the goods have been previously re-imported, check the relevant section.

- Fill in the vehicle or flight number that was used for importing the goods.

- State the supplier's name as listed on the invoice.

- Enter the total invoice value clearly in the corresponding field.

- Complete the gross weight of the shipment in kilograms.

- Fill in the date on the invoice to ensure all documentation aligns.

- Provide a detailed description of the commodities being imported, including their unit of measurement.

- Specify the quantity of each imported item as per your records.

- Calculate and input the assessable value for BST and customs duty as instructed, in Nu.

- Include information about sales tax rates and the corresponding amounts.

- Verify all total sums for customs duty and other applicable taxes before finalizing.

- Provide your receipt number and date to confirm payment of any duties.

- Read the declaration statement carefully, ensuring that all information is true and correct.

- Sign the form and include your name as the importer or agent.

- Fill in the date of signature before final submission.

- Finally, save the changes, download, print or share the completed form as required.

Complete your CD Form-III online for a smooth import process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.