Loading

Get Use This Bformb To Tell Us Who You Want To Be The Beneficiary Of The Balances In Your Tiaa- B - Bnl

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Use This Bformb To Tell Us Who You Want To Be The Beneficiary Of The Balances In Your TIAA-B-Bnl online

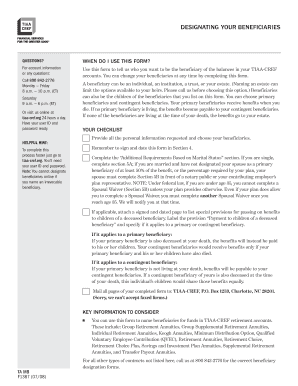

This guide provides clear, step-by-step instructions for completing the Use This Bformb To Tell Us Who You Want To Be The Beneficiary Of The Balances In Your TIAA-B-Bnl form online. By following these steps, you can ensure your beneficiary designations are accurately recorded and updated.

Follow the steps to successfully complete the beneficiary designation form.

- Click the 'Get Form' button to obtain the form and open it in your online document management system.

- Provide your personal information in section 1. Include your first name, middle initial, last name, social security number, date of birth, and daytime telephone number. Make sure to check the relevant box if you want the same beneficiary designation for all contracts or if you prefer to apply it to specific contracts.

- In section 2, choose the applicable annuity contract numbers. Select option A if the designation applies to all of your TIAA-CREF annuity contracts. If not, select option B and list the specific contract numbers.

- Move to section 3 to choose your beneficiaries. List primary beneficiaries and their details, including their name, social security number or tax identification number, percentage of benefits, relationship, date of birth, and gender. Make sure the total percentage for all primary beneficiaries is 100%, and do the same for contingent beneficiaries.

- Sign and date the form in section 4. Confirm your understanding of the terms and conditions regarding the designation of beneficiaries.

- Complete section 5 based on your marital status. If you are single, fill out section 5A. If married, complete section 5B, ensuring your spouse signs and dates the section, with a notary public or employer plan representative witnessing their signature.

- If needed, attach a signed and dated page listing special provisions for passing on benefits to children of a deceased beneficiary. Label it appropriately and clearly define the conditions.

- Finally, ensure all pages of the completed form are mailed to TIAA-CREF at the provided address. Remember, faxed forms are not accepted.

Complete your beneficiary designation accurately by filling out the form online today.

Your primary beneficiary is the person or entity that first receives the proceeds of your account upon your death. The contingent (secondary) beneficiary is your second choice to receive the benefit, only if the primary beneficiary dies before you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.