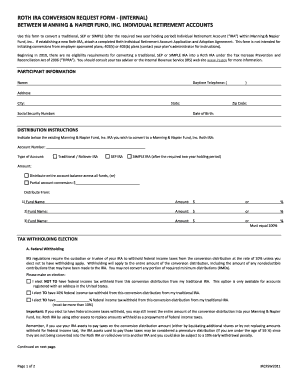

Get Mutual Fund Name Roth Ira Conversion Form ( Internal )

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:Business, legal, tax and other e-documents demand an advanced level of compliance with the law and protection. Our forms are updated on a regular basis according to the latest amendments in legislation. Additionally, with us, all of the information you include in the MUTUAL FUND NAME ROTH IRA CONVERSION FORM ( INTERNAL ) is protected against loss or damage by means of top-notch encryption.

The tips below will allow you to complete MUTUAL FUND NAME ROTH IRA CONVERSION FORM ( INTERNAL ) quickly and easily:

- Open the form in our feature-rich online editing tool by hitting Get form.

- Complete the requested fields that are marked in yellow.

- Click the arrow with the inscription Next to move from field to field.

- Go to the e-autograph solution to e-sign the form.

- Put the date.

- Read through the entire document to be sure that you have not skipped anything.

- Press Done and save the new form.

Our service allows you to take the entire process of submitting legal forms online. Due to this, you save hours (if not days or weeks) and get rid of additional payments. From now on, fill in MUTUAL FUND NAME ROTH IRA CONVERSION FORM ( INTERNAL ) from the comfort of your home, workplace, or even on the move.

A taxpayer who converted a traditional IRA to a Roth IRA will be issued Form 1099-R showing the total distribution from the traditional IRA. A Roth IRA conversion must be reported on Form 8606.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.