Loading

Get Instructions For Employee (also See Notice To Employee, On The Back Of Copy B - Budgetingandpayroll

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Employee (Also See Notice To Employee, On The Back Of Copy B - Budgetingandpayroll online

Filling out the Instructions For Employee form can be straightforward when approached step-by-step. This guide will help you understand each section and field of the form, making the process easier and ensuring that you comply with all necessary reporting requirements.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to access the form and open it for editing.

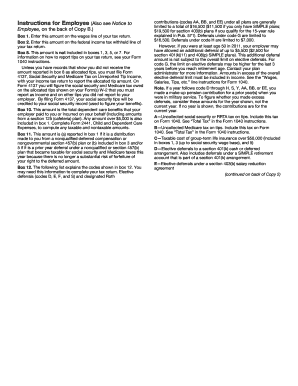

- In Box 1, enter the total amount of wages to be reported on your tax return. This should include all necessary earnings from your employment.

- For Box 2, record the total federal income tax withheld during the tax year. This figure can be found on your W-2 form.

- In Box 8, document any allocated tips. Keep in mind that you must report this amount and, if applicable, file Form 4137 to address unreported tip income.

- In Box 10, indicate the dependent care benefits provided by your employer. If the amount exceeds $5,000, you will need to account for this amount in Box 1.

- Box 11 should contain information regarding any distributions made to you from certain types of deferred compensation plans. Ensure you categorize this amount correctly.

- For Box 12, be sure to include any applicable codes and amounts based on elective deferrals and contributions.

- In Box 13, check the ‘Retirement plan’ box if you are enrolled in one, as this can impact the deductibility of IRA contributions.

- Once all fields are filled accurately, review the document for any errors. You can then save changes, download, print, or share the completed form as necessary.

Start completing the Instructions For Employee form online to ensure compliance and ease during tax season.

How to prevent or stop backup withholding. To stop backup withholding, you'll need to correct the reason you became subject to backup withholding. This can include providing the correct TIN to the payer, resolving the underreported income and paying the amount owed, or filing the missing return(s), as appropriate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.