Get Co Lock-in Disclosure Form 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO Lock-in Disclosure Form online

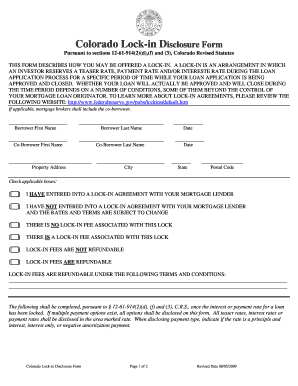

Filling out the Colorado Lock-in Disclosure Form online is a straightforward process that helps you document your loan terms clearly. This guide will provide you with step-by-step instructions to ensure a smooth completion of the form.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the last name of the primary borrower in the designated field.

- Next, enter the first name of the primary borrower in the corresponding field.

- If applicable, input the first name and last name of the co-borrower in the respective fields.

- Fill in the property address, including the city, state, and postal code.

- Specify if you have entered into a lock-in agreement with your mortgage lender by checking the appropriate box.

- Indicate whether there is a lock-in fee associated with this lock by checking the relevant box.

- If there are any terms or conditions regarding refundability of lock-in fees, please provide details in the space provided.

- Complete the sections for interest or payment rates, including teaser rates, payment types, and any associated penalties.

- Ensure to sign and date the form in the designated signature fields for both the primary borrower and co-borrower.

- Finally, the mortgage loan originator should print their name, sign, and provide their license number before submitting.

- After filling out all sections, you can save your changes, download, print, or share the form as necessary.

Take the next step towards securing your loan by completing the Colorado Lock-in Disclosure Form online.

One primary purpose of the Home Mortgage Disclosure Act is to promote transparency in the mortgage lending process. This law requires lenders to report data about mortgage applications, loans, and the demographics of borrowers. By ensuring this information is accessible, the act helps identify discriminatory lending practices and supports fair access to loans. Understanding the details surrounding the CO Lock-in Disclosure Form can guide you in navigating these regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.