Loading

Get Permanent Application For Property Tax Credit/exemptions - Leenh

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PERMANENT APPLICATION FOR PROPERTY TAX CREDIT/EXEMPTIONS - Leenh online

Filling out the permanent application for property tax credit and exemptions is a crucial step for property owners seeking financial relief. This guide provides a comprehensive, step-by-step approach to help users navigate the application process with confidence and clarity.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

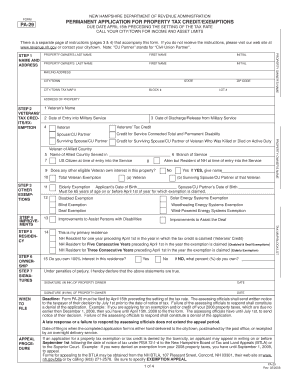

- Begin by inputting the property owner's last name, first name, and initial in the designated fields. Include the mailing address, city or town, state, tax map number, block number, lot number, and the property's address.

- In the veterans' tax credit/exemption section, enter the veteran's name, dates of entry and discharge from military service. Check applicable boxes for types of credits such as veteran’s tax credit or surviving spouse credit.

- For additional exemptions such as elderly or disabled exemptions, check the relevant boxes and provide requested dates of birth. Ensure to mention any improvements made to assist persons with disabilities.

- Confirm residency status by selecting options indicating whether the property is your primary residence and the duration of New Hampshire residency.

- Indicate ownership percentage by checking the appropriate box; if you do not own 100%, please specify the ownership percentage.

- All property owners must sign the application in ink. If there are multiple owners, attach additional pages with signatures as necessary.

- Review all information for accuracy, then save any changes made. You can download, print, or share the completed form as required.

Start filling your PERMANENT APPLICATION FOR PROPERTY TAX CREDIT/EXEMPTIONS online today for a smoother application experience.

Related links form

This is a free program; however, an application is required. You must be a property owner, co-owner or a purchaser named in a contract of sale. You must occupy your home as your principal place of residence as of 12:01 a.m., January 1 each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.