Loading

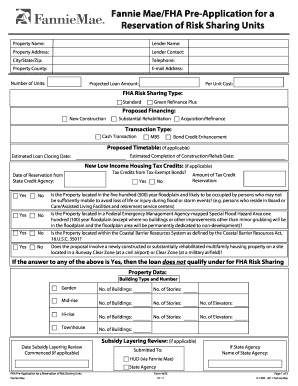

Get Fannie Mae/fha Pre-application For A Reservation Of Risk Sharing Units Property Name: Lender Name

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fannie Mae/FHA Pre-Application For A Reservation Of Risk Sharing Units online

This guide provides clear and comprehensive instructions for users filling out the Fannie Mae/FHA Pre-Application For A Reservation Of Risk Sharing Units form. By following these steps, users can successfully complete the application with confidence.

Follow the steps to complete your pre-application with ease.

- Click the ‘Get Form’ button to obtain the form and access it in your preferred online editing tool.

- Begin by entering the property name and lender name in the specified fields at the top of the form.

- Fill out the property address, including the city, state, and zip code, ensuring all details are accurate.

- Provide the lender contact information, including the telephone number and email address for correspondence.

- Indicate the number of units and the projected loan amount in the relevant fields.

- Specify the per unit cost and select the applicable FHA risk sharing type from the provided options.

- Detail the proposed financing method by choosing between new construction, substantial rehabilitation, or acquisition/refinance.

- Select the transaction type, indicating whether it is a cash transaction, MBS, or bond credit enhancement.

- If applicable, fill out the proposed timetable, including estimated completion and loan closing dates.

- Provide information regarding low-income housing tax credits, including the reservation date and tax-exempt bond status.

- Answer the questions about the property’s location concerning floodplain risks and coastal barriers, understanding these factors may impact application eligibility.

- Complete the property data section, detailing the building type, number of stories, and any relevant subsidy layering review information.

- Provide details about the eligibility characteristics, ensuring to disclose any affordability restrictions and related regulatory agreements.

- Fill out the borrower information section, listing names and addresses of all principal stakeholders related to the loan.

- Confirm whether any legal challenges are pending against the borrower or principals.

- Certify that all provided information is accurate and complete, and enter the date and lender's name with title.

- Finally, attach all required documentation, such as pro forma income and expenses, site location map, and any evidence of tax credit allocation.

Complete your forms online for a streamlined application process!

Fannie Mae Conforming Loan Limits The FHFA sets requirements for Fannie Mae called conforming loan limits. These mortgage loans, known as conforming mortgages, are guaranteed by Fannie Mae. This means they'll make investors whole if the borrower goes into default.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.