Loading

Get Topic No. 427 Stock Optionsinternal Revenue Service - Irs.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Topic No. 427 Stock Options Internal Revenue Service - IRS.gov online

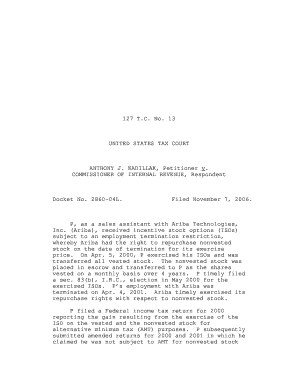

Navigating tax documentation can be a challenging task, especially when it involves stock options. This guide will provide you with clear, step-by-step instructions for filling out Topic No. 427 Stock Options on the IRS website.

Follow the steps to accurately complete your tax obligations regarding stock options.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the instructions carefully. Each section of the form has specific requirements. Gather your financial documents related to stock options, including details on vested and nonvested shares.

- Complete the first section by entering your personal information, such as your name, address, and Social Security number.

- In the next section, provide details about the stock options you exercised. Include the grant date, exercise price, number of shares, and any relevant market value information.

- If you made a section 83(b) election, it is crucial to indicate this on the form. Clearly state the date of the election and include supporting details.

- Carefully review all numbers and calculations to ensure accuracy, especially regarding the fair market value at the time of exercise and any capital gains or losses.

- Once you have completed all sections, save your changes. You can download or print the completed form for your records and to submit to the IRS.

Take action now and complete your Topic No. 427 Stock Options documentation online.

Example for a Non-Qualified Stock Option: You made $9. This $9 is taxed as wages and will show up on your W-2. Since there was a stock sale, it ALSO shows up on your 1099-B as a $9 gain. A $9 gain in two places could lead to a maximum tax rate of over 100% if reported twice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.