Loading

Get Ar2210a Click Here To Clear Form Click Here To Print Document 2011 Arkansas Individual Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the AR2210A CLICK HERE TO CLEAR FORM Click Here To Print Document 2011 Arkansas Individual Income Tax online

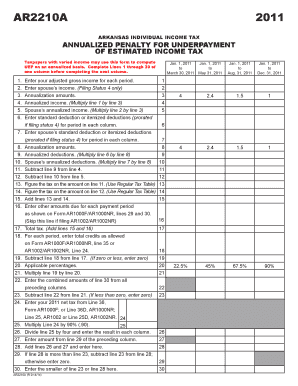

Filling out the AR2210A form is an essential step for taxpayers in Arkansas who need to calculate their annualized penalty for underpayment of estimated income tax. This guide will provide users with clear, step-by-step instructions to complete the form accurately and efficiently.

Follow the steps to fill out the AR2210A form online:

- Click the ‘Get Form’ button to access the AR2210A form and open it for editing.

- Complete lines 1 through 30 for the first column, entering your adjusted gross income and any applicable deductions.

- For Line 1, enter your adjusted gross income for each specified period.

- If applicable, for Line 2, enter your partner's income only if filing under Status 4.

- On Line 3, input the annualization amounts relevant to each income period.

- Calculate your annualized income for Line 4 by multiplying your adjusted gross income (Line 1) by the annualization amount (Line 3).

- For Line 5, calculate your partner's annualized income similarly, using Line 2 and Line 3.

- Enter your standard or itemized deductions for the period in Line 6, ensuring adjustments for filing status as necessary.

- If you have a partner, enter their standard or itemized deductions for Line 7.

- For Line 8, list the annualization amounts applicable to your deductions.

- Calculate annualized deductions for Line 9 by multiplying your deductions (Line 6) by the annualization amount (Line 8).

- If applicable, calculate your partner's annualized deductions for Line 10.

- Subtract your annualized deductions (Line 9) from your annualized income (Line 4) for Line 11.

- Subtract your partner's annualized deductions (Line 10) from their annualized income (Line 5) for Line 12.

- Use the Regular Tax Table to figure the tax on the amount in Line 11 for Line 13.

- Use the Regular Tax Table to figure the tax on the amount in Line 12 for Line 14.

- Add the amounts from Lines 13 and 14 to arrive at Line 15.

- Complete Line 16 by entering any additional amounts due for each payment period as shown on Form AR1000F/AR1000NR.

- Calculate the total tax for Line 17 by adding Lines 15 and 16.

- List total tax credits allowed for each payment period on Line 18, using the relevant lines from Form AR1000F/AR1000NR.

- Subtract Line 18 from Line 17; if the result is zero or less, enter zero on Line 19.

- Follow the remaining steps through Lines 20 to 30, ensuring to record all applicable penalties and final calculations.

- After completing all lines, save your changes, download your form, or print it for submission.

Complete your AR2210A form online today to ensure compliance with Arkansas tax regulations.

2021 ar1000f AR1000NR Part-Year or Nonresident Individual Income Tax Return - lived in Arkansas less than six months, or lives outside of Arkansas but receives Income ... Forms - Arkansas Department of Finance and Administration.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.