Loading

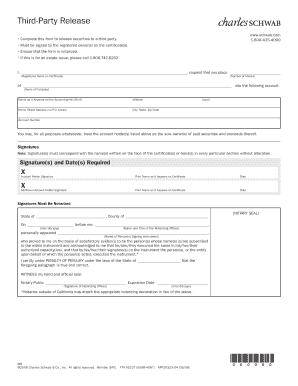

Get Important Instructions For Completing This Form - Ocbuddhist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Important Instructions For Completing This Form - Ocbuddhist online

Completing the Important Instructions For Completing This Form - Ocbuddhist is an essential step for users. This guide aims to provide clear and comprehensive instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete your form seamlessly.

- To begin, click the ‘Get Form’ button to download the form. Open it in your chosen document editor.

- Enter the required information in the corresponding fields, starting with your first name. You can navigate through the fields using your mouse or by pressing the 'Tab' key to move smoothly between them.

- If you need to clear any information you've entered, click the 'CLEAR' button to reset the fields before submitting.

- Once you have completed all sections of the form, click the 'PRINT' button to print it out. Remember, Adobe® Reader® does not permit saving, so make sure to print your form immediately.

- Review your completed form thoroughly. Ensure all information is accurate and legible. Then, sign and date the form as required.

- After signing, you can submit the form by bringing it to the nearest Charles Schwab branch or mailing it to one of the provided addresses based on your state of residency.

- If required, enclose any additional materials needed with your form, such as payment for an initial deposit, to ensure your submission is complete.

- If you have any questions or require assistance while filling out the form, please call 1-800-435-4000 for support.

Complete your forms online today and ensure a smooth submission process.

Complete form BOE-266, Claim for Homeowners' Property Tax Exemption. Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.