Loading

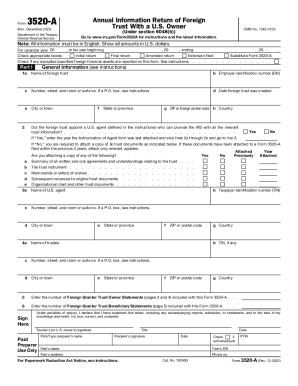

Get Irs 3520-a 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 3520-A online

The IRS 3520-A form is an annual information return of a foreign trust with a U.S. owner. This guide will provide clear, step-by-step instructions to help you complete the form online, with a focus on ensuring accuracy and compliance.

Follow the steps to complete the IRS 3520-A form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Provide general information about the foreign trust, including its name, employer identification number (EIN), address, and the date it was established.

- If no U.S. agent is appointed, attach required trust documents, including a summary of any agreements and the trust instrument.

- Enter the number of Foreign Grantor Trust Owner and Beneficiary Statements you are including with this form.

- Once finished, you can save your changes, download a copy, print the form, or share it according to your needs.

Complete your IRS 3520-A filing online to ensure timely and accurate submission.

The U.S. owner is subject to an initial penalty equal to the greater of $10,000 or 5% of the gross value (defined later) of the portion of the trust's assets treated as owned by the U.S. person at the close of that tax year if the foreign trust (a) fails to file a timely Form 3520-A, or (b) does not furnish all of the ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.