Loading

Get Irs 8404 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8404 online

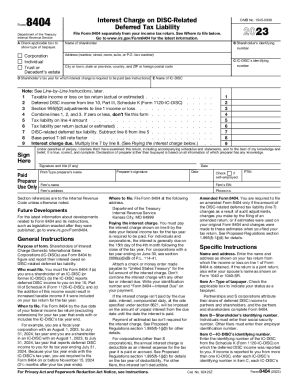

Filling out the IRS Form 8404, which addresses interest charges on deferred tax liability related to Interest Charge Domestic International Sales Corporations (IC-DISCs), requires careful attention to detail. This guide provides straightforward, step-by-step instructions to assist users in completing this form online accurately.

Follow the steps to fill out the IRS 8404 online.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Begin by checking the applicable box to indicate your taxpayer status (corporation, individual, trust, or decedent's estate). This is crucial for proper processing.

- Enter the shareholder’s identifying number in the designated field. Individuals should provide their social security number, while other filers must input their employer identification number.

- Fill in the IC-DISC’s identifying number as reported on your Schedule K (Form 1120-IC-DISC). If you have income from multiple IC-DISCs, you can list them accordingly.

- Specify the tax year for which the interest charge applies. Input either the calendar year or the relevant beginning and ending dates as shown on your tax return.

- Proceed to calculate your taxable income or loss as reported on your tax return for the specified tax year. This may be actual or estimated if your return is not yet filed.

- Report the deferred DISC income from your Schedule K (Form 1120-IC-DISC) for the corresponding tax year.

- Enter any relevant adjustments to your income based on section 995(f)(2). Document these adjustments as required.

- Combine the entries from your taxable income, deferred DISC income, and any adjustments to compute the total liability. If this amount is zero or less, do not submit the form.

- Review and sign the form, ensuring that the declaration is complete and correct as per your knowledge.

- Once completed, save your changes, and you can choose to download, print, or share the form as necessary.

Complete your documents online today for a seamless filing experience.

You must file Form 8404 if (a) you are a shareholder of an IC-DISC (or former IC-DISC); (b) the IC-DISC reports deferred DISC income to you on line 10, Part III of Schedule K (Form 1120-IC-DISC); and (c) the addition of this income would result in increased taxable income if it were included on your tax return for the ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.