Loading

Get Irs 990 - Schedule D 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule D online

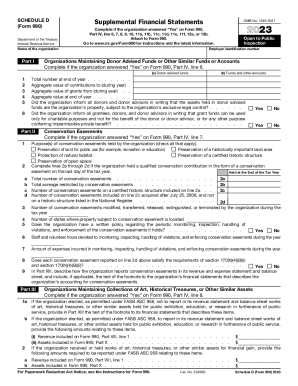

The IRS 990 - Schedule D is a crucial document for organizations to report supplemental financial statements. This guide provides clear instructions on how to complete this form online, ensuring that your organization meets its reporting requirements efficiently.

Follow the steps to fill out Schedule D effectively.

- Press the ‘Get Form’ button to access the IRS 990 - Schedule D online and open it for editing.

- Begin by entering the name of the organization at the top of the form, followed by the employer identification number.

- Proceed to Part I to provide details for organizations maintaining donor advised funds or similar accounts, indicating the number and total value of contributions and grants.

- Navigate to Part II to report on conservation easements, including the purposes they serve and total acreage, if applicable.

- Complete Part III if your organization has collections of art or historical treasures. Provide financial details regarding their reporting.

- In Part IV, address any escrow and custodial arrangements, explaining the nature of any contributions or assets not included on Form 990.

- Fill out Part V for endowment funds, ensuring to report contributions, expenditures, and the intended uses of these funds.

- For organizations with land, buildings, and equipment, complete Part VI with respective costs and accumulated depreciation.

- In Part VII, provide details regarding investments in other securities, ensuring to account for their valuation methods.

- Complete Part VIII for program-related investments and Part IX for any other assets held by the organization.

- In Part X, report any other liabilities, ensuring to reconcile against Form 990.

- Part XI necessitates the reconciliation of revenue from audited financial statements to the return; ensure accuracy in all entries.

- Similarly, in Part XII, reconcile the expenses reported in financial statements with those on the return.

- Lastly, use Part XIII for supplemental information, providing required descriptions and any additional information needed.

- Once all sections are filled out accurately, save any changes, and download, print, or share the form as necessary.

Complete your IRS 990 - Schedule D online to ensure compliance and accurate reporting.

Nonprofit Organizations use schedule B to provide additional information on contributions reported on Form 990, 990-EZ, and 990-PF. Eventually, a Non Profit Organization must file Schedule B with Form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.