Loading

Get Irs 990 - Schedule K 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule K online

Completing the IRS 990 - Schedule K can seem daunting, but with the right guidance, you can navigate through it efficiently. This guide provides clear steps to help you fill out this important form online.

Follow the steps to complete your IRS 990 - Schedule K online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

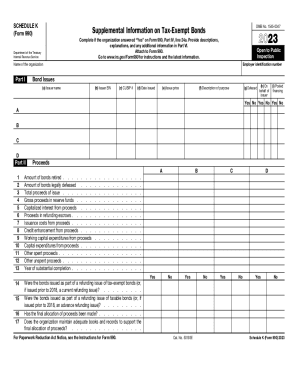

- Begin by entering your organization’s name and employer identification number at the top of the form. This information is essential for proper identification.

- Move to Part I, titled 'Bond Issues'. Fill in issuer name, issuer EIN, CUSIP number, issue date, issue price, and a description of the purpose of the bond. Indicate whether the bond was defeased and if any pooled financing was involved by selecting 'Yes' or 'No' in the corresponding fields.

- Proceed to Part II, which details Proceeds. Here, report the amounts associated with various categories such as bonds retired, gross proceeds, and issuance costs. Ensure accuracy as these amounts impact overall financial reporting.

- In Part III, assess and report on Private Business Use. Answer the questions regarding partnerships, lease arrangements, and management contracts. Enter relevant percentages as needed.

- In Part IV, focus on Arbitrage. Indicate if Form 8038-T has been filed, and provide relevant responses to follow-up questions that assess the bond's compliance and characteristics.

- Part V asks about procedures for corrective actions. Confirm if written procedures are established to ensure compliance with federal tax requirements.

- Finally, in Part VI, provide any supplemental information necessary to clarify or support your responses throughout the form. This is important for transparency and compliance.

- After completing all sections, review the form for accuracy. Save your changes, download a copy for your records, and prepare to submit it as part of your IRS 990 filing.

Start filling out the IRS 990 - Schedule K online to ensure your organization stays compliant.

Schedule J is the Internal Revenue Service form used when you want to average your fishing or farming income. When income averaging is beneficial. Farming businesses that qualify for income averaging. Fishing businesses and income averaging.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.