Loading

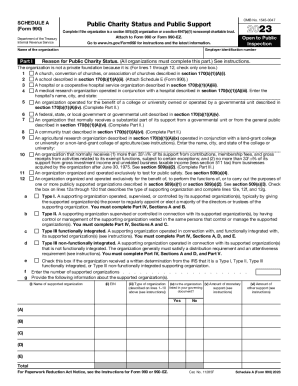

Get 2023 Schedule A (form 990). Public Charity Status And Public Support

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Schedule A (Form 990). Public Charity Status And Public Support online

Filing the 2023 Schedule A is essential for organizations seeking to establish their public charity status and demonstrate their public support. This guide provides a clear and detailed walkthrough for users, regardless of their legal experience, to successfully complete this form online.

Follow the steps to complete the Schedule A form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering the name of the organization and the employer identification number at the top of the form. Ensure that this information is accurate as it is vital for processing.

- Complete Part I, which discusses the reason for public charity status. Check only one box that best describes the organization's status as per the provided options, such as being a church, school, or government entity.

- If applicable, fill in Part II for organizations that checked boxes 5, 7, or 8 in Part I. This involves detailing public support received, including gifts, grants, and any contributions.

- Proceed to compute the total support in Part II. Here you will add up the total contributions and other sources of income to determine public support. Make sure to accurately subtract any claimed amounts that exceed 2%.

- Move to Part III if the organization falls under section 509(a)(2). Similar to Part II, you will need to provide details about public support, total support, and any related income.

- If your organization is a supporting organization (checked in Part I), fill out Part IV. Answer the questions regarding the organization’s linkage and operational oversight by its supported organizations.

- Complete Part V, which applies to Type III non-functionally integrated supporting organizations. Here you’ll calculate adjusted net income and minimum asset amounts.

- Finally, provide any supplemental information required at the end of the document. This is an opportunity to clarify any previous responses or give additional context as needed.

- Once all parts are completed, review the entire form for accuracy and completeness before submitting. You can save changes, download, print, or share the completed form as required.

Complete your Schedule A form online now to maintain your public charity status!

It confirms that the charity is supported by the general public with at least 33% of revenue coming from small donors who give less than 2% of the organization's revenue, from other public charities, and/or from the government.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.